February 2025 brought significant volatility to the stock market, with sectors reacting to economic data releases, shifting interest rate expectations, and geopolitical concerns. While some industries struggled, others found opportunities amid the uncertainty. Here’s a breakdown of key assets and industries, along with how AlphaGrail’s strategic approach capitalized on market movements.

Market Overview: Key Stocks and Sectors in February 2025

Energy: Devon Energy Corp. (DVN)

The energy sector faced fluctuations due to global demand uncertainties and oil price movements. As of February 25, 2025, DVN is trading at $37.31, reflecting a slight decrease of 0.453% from the previous close. The energy sector faced challenges due to fluctuating oil prices and global demand uncertainties.

Technology: NVIDIA Corp. (NVDA)

NVIDIA experienced a decline of -3.07% in February, impacted by concerns over AI chip demand and China’s advancements in artificial intelligence. Despite its strong long-term positioning, near-term pressures weighed on its stock performance.

Healthcare: Vertex Pharmaceuticals, Inc. (VRTX)

VRTX showed relative stability, closing February at $481.65, down -0.48% from the previous close. The healthcare sector remained resilient despite broader market volatility.

Consumer Staples: General Mills, Inc. (GIS)

General Mills benefited from defensive positioning, posting a +0.57% increase as investors sought stability during uncertain times.

Industrials: Cummins Inc. (CMI)

CMI declined -1.78% amid concerns over global economic growth and trade policy uncertainties, reflecting broader industrial sector headwinds.

Telecommunications: T-Mobile US Inc. (TMUS)

TMUS saw a +1.09% gain, supported by strong earnings and steady demand, proving that defensive sectors can provide value even in turbulent markets.

How AlphaGrail Acted During Market Volatility

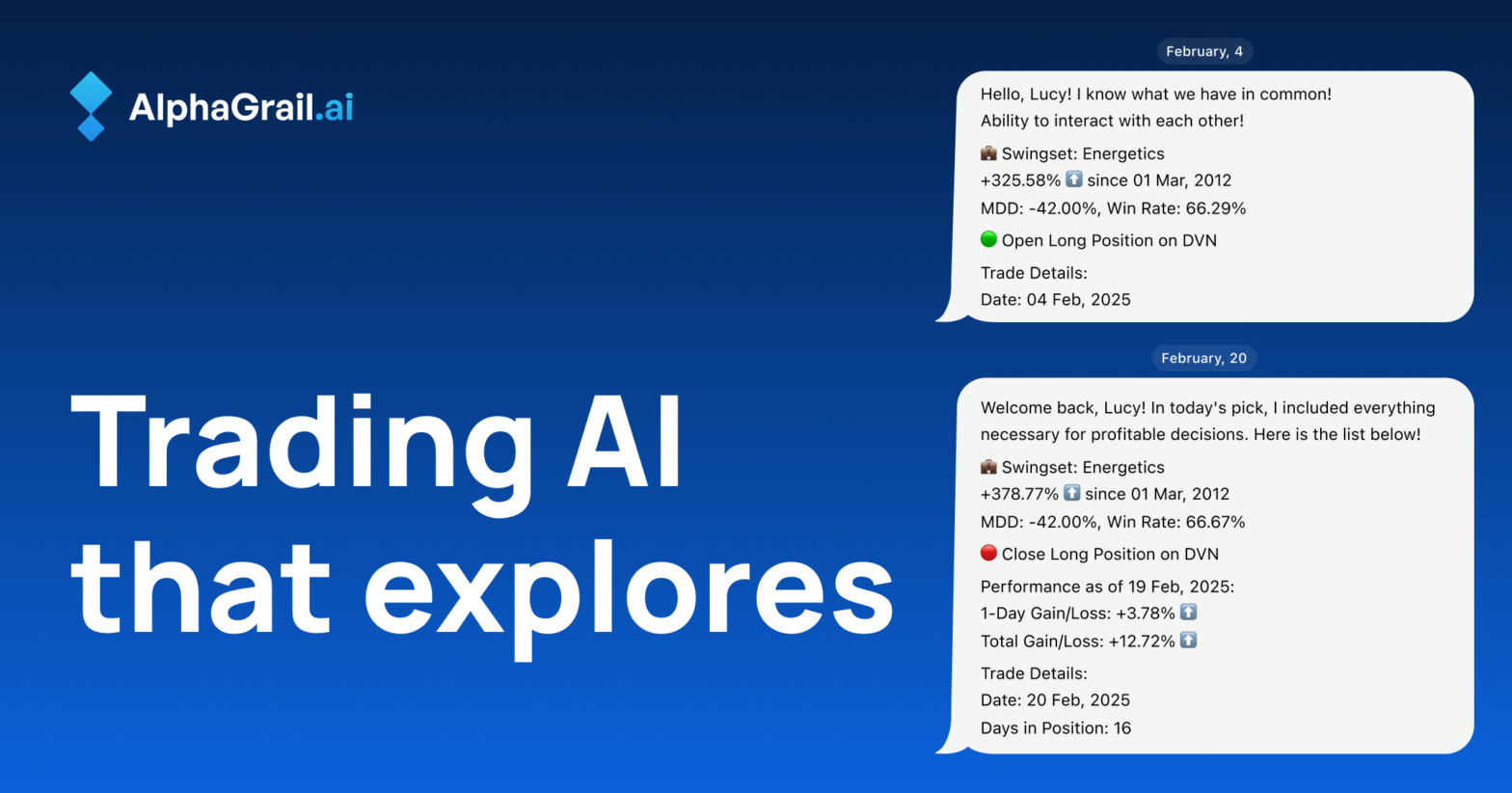

AlphaGrail’s advanced analytics and strategic positioning allowed it to identify profitable opportunities during the market’s ups and downs. In the energy sector, our Swingsets strategy detected an entry opportunity in DVN on February 4, holding the position until February 20, and securing a +14.16% gain ⬆️ in 16 days. By analyzing price action, sector trends, and reinforcement learning insights, AlphaGrail successfully navigated the volatility.

Looking Ahead

Market uncertainty is inevitable, but with the right tools and strategies, traders can turn turbulence into opportunity. AlphaGrail continues to provide data-driven insights, helping traders stay ahead in dynamic market conditions.

Stay updated with AlphaGrail for more market insights and strategic opportunities!

FAQ About AlphaGrail.ai

1. What is AlphaGrail.ai?

AlphaGrail.ai is an AI-powered platform that helps traders make informed stock decisions using deep data analysis and reinforcement learning.

2. How does AlphaGrail.ai work?

It analyzes stock market data, groups assets into ‘Swingsets’ based on industry and performance, and provides insights to traders.

3. Can AlphaGrail.ai predict market movements?

AlphaGrail.ai does not provide trend forecasts but helps traders make smarter decisions based on past data and AI-driven analysis.

FAQ About Stocks and Trading

1. What is stock market volatility?

Stock market volatility refers to how much stock prices fluctuate over a period of time. High volatility means big price swings, while low volatility means stable prices.

2. Why do stock prices change so much?

Stock prices move due to economic reports, company earnings, investor sentiment, and global events.

3. How do I know when to buy or sell a stock?

There’s no perfect timing, but researching trends, understanding market conditions, and using AI-powered tools like AlphaGrail.ai can help.

4. Is investing during volatility risky?

Yes, but with the right strategies—like diversifying investments and using data-driven insights—you can manage risk effectively.